What you need to know about online mortgages

Requesting a home loan, as well as shutting one, can be a tiresome method. Lenders needs to check your credit rating records as well as research your credit report. You’ll need to deliver copies of such documentations as your most recent wages short ends, bank claims and also tax returns to validate your income. And […]

Home Equity

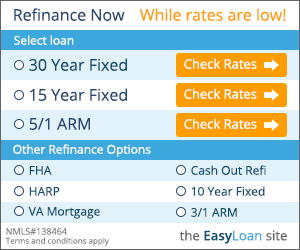

8 reasons to refinance your mortgage

With mortgage rates of interest seeming to strike lows typically, it can be maddening for property owners that would like to re-finance their mortgage loan at the lowest interest rate they can find. What is actually low today could be reduced tomorrow. When, exactly, is the greatest time to refinance your mortgage? All of it […]

FHA mortgage insurance explained

When you get an FHA home loan, you need to pay for FHA mortgage insurance. This is true regardless of whether you’re buying or refinancing, getting a 203(k) or Title 1 home improvement loan, or if you’re a senior citizen taking out a reverse mortgage. Mortgage insurance fees are always part of the package. FHA mortgage insurance coverage superiors do […]

Decoding Membership Perks: Is AARP Worth It for You?

When pondering the question, ‘is AARP worth it,’ potential members are seeking a straightforward answer: do the benefits outweigh the costs? This article objectively examines AARP’s membership fee against the plethora of discounts and services it offers, addresses the potential drawbacks, and helps you determine if AARP aligns with your needs and values. Key Takeaways […]

Real Estate

Strategies for Millennial Homebuyers

As any individual who has seen “Home Hunters” or even every other home purchasing TV show knows, locating your very first property to get is actually all about tradeoffs. If you desire to live near the facility of town, you most likely will not obtain a big yard. If you may only pay for a […]

This week update

What to Know Before Co-Signing a Mortgage

If you thought receiving a home loan was challenging, you are actually not the exception. Virtually an one-fourth of all house customers require aid coming from friends and family as co-signers on a home loan to apply for a mortgage, depending on to a latest report. Of every one of the home purchase lendings in […]

Good and Bad Reasons for Tapping Home Equity

Back in 2001 when financial institutions were liberal along with house equity lendings and enabled up to 125 percent of a residence’s equity to be obtained, Atlanta realty broker Bruce Ailion acquired a home equity line of credit for $75,000 on his property. The house he had actually purchased for $280,000 was actually valued at […]

Getting a mortgage when your spouse has bad credit

Involved couples and also newlyweds trying to buy a property perhaps don’t desire to have a complicated discussion on financial issues before a finance policeman. But that’s what it may become if one of all of them has negative credit report as well as this is actually the very first time they’re learning about one […]